| Payment type |

Cards |

|---|---|

| Channel | Online In person |

| Register of Region | US |

| Support of Region | Sweden, Italy, Belgium, Estonia, Poland, Ukraine, Croatia, Gibraltar, Slovakia, Lithuania, Cyprus, Denmark, Malta, Slovenia, Luxembourg, Latvia, Romania, Spain, Austria, Ireland, Netherlands, Norway, Liechtenstein, Hungary, Czech Republic, Switzerland, United Kingdom, France, Germany, Portugal, Iceland, Finland, Turkey, Greece,Australia, New Zealand,United States, Canada,Hong Kong, Japan, Vietnam, Thailand, Malaysia, Singapore, India, South Korea, Philippines, China, Indonesia,Brazil, Mexico,United Arab Emirates, Kuwait |

| Settlement currency | All supported currencies |

| Payment Cost |

Visa is a global payment technology company that connects customers, businesses, banks, and governments, enabling them to use digital currencies instead of cash or checks. As a financial intermediary, Visa operates one of the most advanced and extensive payment processing networks. Visa is a card scheme, but it does not issue cards or set rates. Instead, it provides infrastructure for authorized issuers and cardholders to facilitate electronic funds transfers (EFT).

Although Visa primarily processes bank card-based transactions, it has expanded its capabilities to accommodate mobile payments, contactless payments, and blockchain-based solutions. Its adaptability is the main reason those who need diverse payment options may choose Visa.

Visa is a major player in the payment processing space and is used by a variety of businesses, from small retailers to large multinational corporations. According to Statista, Visa processed a total of 242 billion transactions worldwide in 2022. Despite its popularity, Visa also has limitations, especially in regions where local payment methods are popular. Markets such as China and some countries in Africa tend to support local card schemes and mobile payment solutions, which offer a different set of features and fee structures.

If businesses want to understand how to use Visa and the impact of Visa payment processing, they should first understand Visa's products and presence in various markets around the world. This includes understanding what types of businesses and customers Visa is best suited to serve.

As mentioned earlier, Visa faces competition in markets where local payment systems are prevalent. While Visa offers many services, including fraud protection and analytics, these services are generally tailored to the needs of large organizations rather than small businesses or startups. Visa focuses on security, applying multiple layers of protection to transactions. However, its security features may not meet the requirements of every business, especially those seeking customized solutions or operating in industries with special compliance needs.

There are approximately 3 billion Visa debit cards in circulation worldwide, indicating that Visa is one of the most widely used and accepted payment card organizations. Major financial institutions, businesses, and governments around the world rely on Visa to facilitate digital currency transactions.

Visa's operations span multiple market sectors and geographic regions, with operations on nearly every continent:

North America and Europe: Visa is a leader in the payment card market, especially in the United States, the United Kingdom, and Ireland. Visa is widely used by customers and businesses for a variety of transaction types, from retail to B2B payments.

APAC: Visa has high acceptance rates in countries such as Japan, Australia, and Singapore. It has gained traction in countries such as China and India with strong domestic payment networks, especially for international transactions.

Latin America: From Brazil to Mexico, Visa is a commonly used payment card organization. It often partners with local financial institutions to provide bank cards and payment solutions that suit local market needs.

Middle East and Africa: Visa has gained acceptance in major economic centers such as the UAE, South Africa, and Saudi Arabia, and is often the first choice for local and international transactions. It has also actively entered markets that are still developing financial and digital payment infrastructure, including countries in Sub-Saharan Africa.

Financial institutions in these regions often choose Visa because of its ample security measures, scalability, and wide global acceptance. Given its wide geographic coverage and deep market penetration, Visa remains the first choice for businesses operating or transacting internationally.

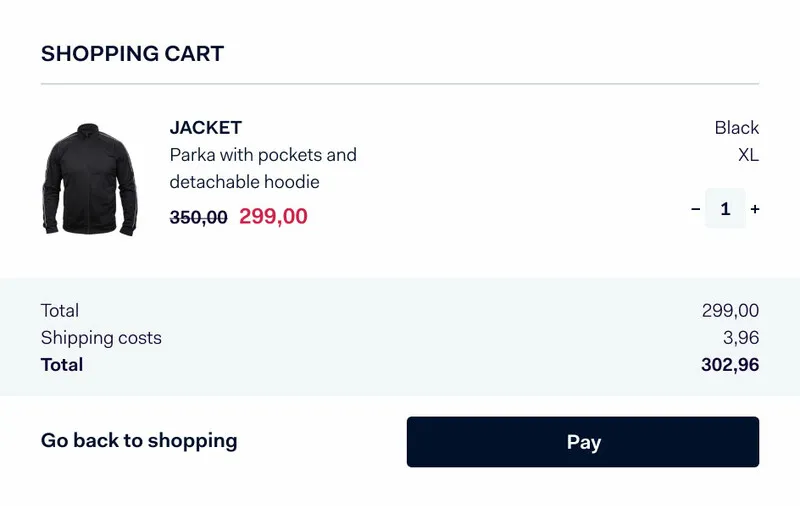

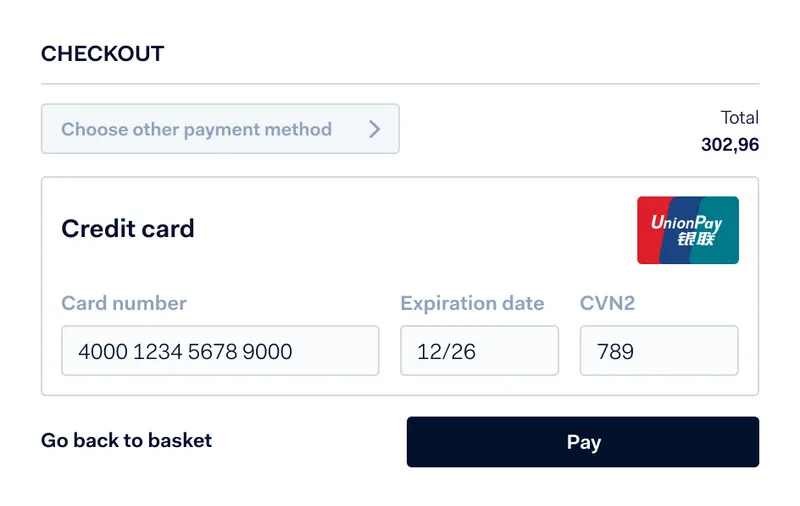

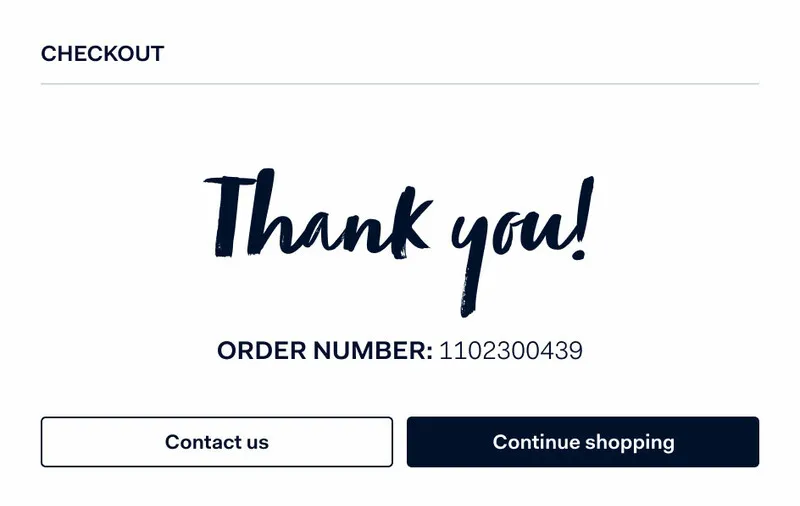

- Desktop

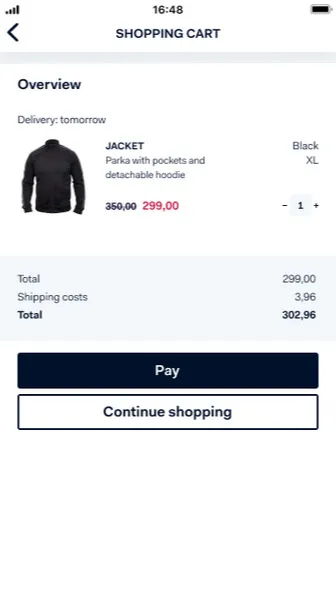

- Mobile

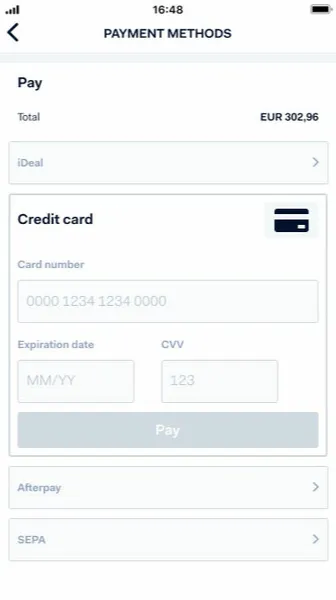

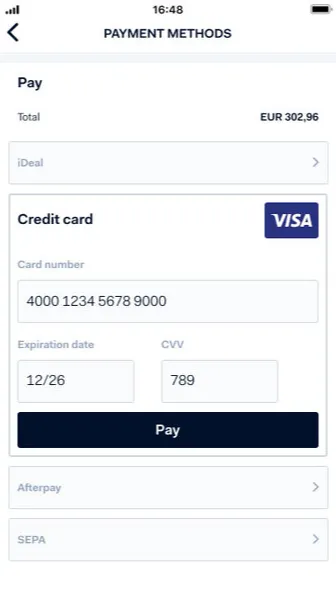

#1

Shopper proceeds to checkout

#2

Shopper selects Credit Card from the list of payment methods available

#3

Shopper enters the details of the Visa card

#4

Payment complete

#1

Shopper proceeds to checkout

#2

Shopper selects Credit Card from the list of payment methods available

#3

Shopper enters the details of the Visa card

#4

Payment complete

- All Reviews(0)

- Payment Proofs

- Questions

Subscribe to Our Newsletter

Apple Pay @ver8225

If conditions permit, I like to use Apple Pay. In theory, NFC is the most secure. And you only need to press twice and touch Face ID. It is also very convenient online. Meituan, Didi and Duoduo all use this.

PayPal @Daniel

I've been very happy with ClickDealer. They’ve been around for a while, and have some great offers that you usually can't find anywhere else. I would definitely recommend them to anyone!